Wisconsin 2035

A Vision for Wisconsin’s Economic Future

Wisconsin 2035

About The Report

Talent Attraction

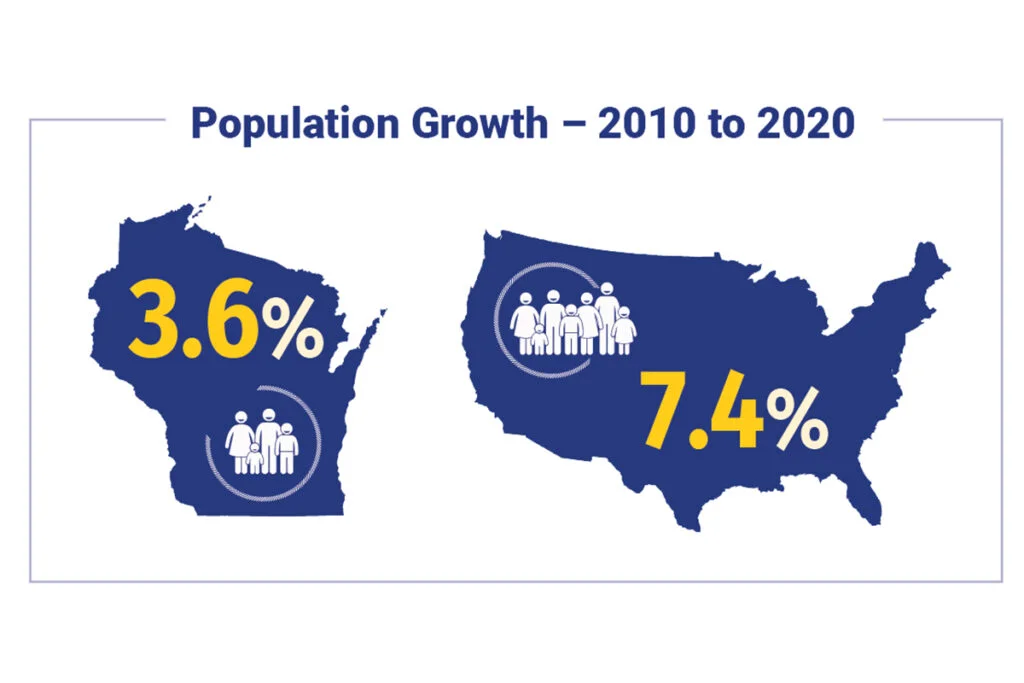

According to the most recent Wisconsin Employer Survey, a sustained talent attraction campaign is quite popular. Nearly three-quarters – 73 percent – of businesses support a taxpayer-funded talent attraction campaign aimed at drawing more people into Wisconsin and filling available jobs.

Business leaders suggested targeting three specific groups of people in a campaign: alumni from Wisconsin colleges and universities; military veterans mustering out of service; and young people looking to leave high-cost, high-tax states like Illinois.

Taxes

From 2013 to 2020, Americans have shifted population toward lower tax states, while leaving high tax states. According to an analysis by Redfin – a national real estate brokerage firm – four people move into low tax states for every one = person who leaves. In contrast, 2.5 people leave high tax states for every one person that moves in.

To remain competitive for talent and promote economic growth through 2035 and beyond, Wisconsin must be on the forefront of tax reform. As other states push proposals to reduce income and other taxes, the Badger State’s ability to keep up depends on bold ideas.

Expanding STEM Education

In a near unanimous point, business leaders interviewed for this report called for added emphasis on STEM education. Not only do they believe it is critical to current jobs in Wisconsin – whether engineering careers or positions in the skilled trades – but the STEM field is only expected to grow in future years.

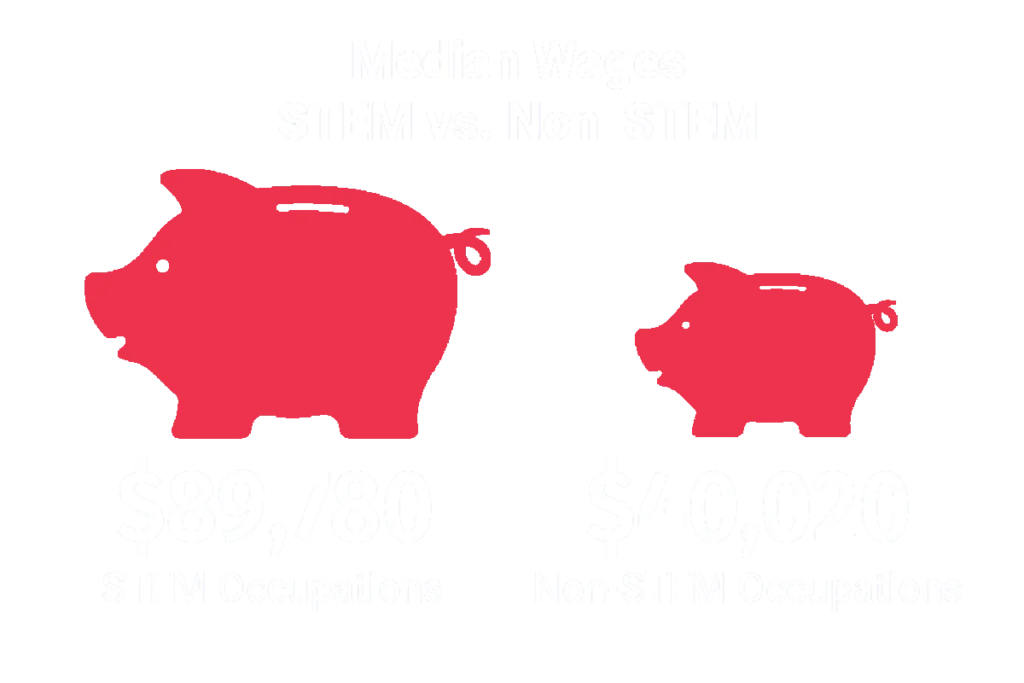

From 2020 to 2030, careers in STEM fields are expected to grow by 10.5 percent, but non-STEM occupations are only expected to grow by 7.5 percent. Additionally, the average income for STEM occupations far exceeds non-STEM occupations. According to the Bureau of Labor Statistics, the median annual wage for STEM occupations in 2020

was $89,780 – more than double the $40,020 for non-STEM occupations.